Northmill issues SEK 500 million senior bond.

Northmill Group AB (publ) has issued a senior unsecured bond of SEK 500 million, with a total framework of SEK 1,000 million and a 3-year tenor.

Northmill Group has issued a senior unsecured bond, with an initial bond issue of SEK 500 million under a total framework of SEK 1,000 million. The tenor of the bond is 3 years. The bond will initially be listed on FWB Frankfurter Wertpapierbörse (Open Market) with ISIN SE0011614973 and subsequently on Nasdaq Stockholm, dated at less than one year from First Issue Date.

“We are very pleased with the successful process and the great interest from investors. The proceeds from the bond issue allow us to continue our growth journey and expand our product portfolio" says Lars Blomfeldt, Chief Executive Officer at Northmill.

Agent for the bond issuance is Nordic Trustee and Agency AB, and the sole bookrunner is Pareto Securities.

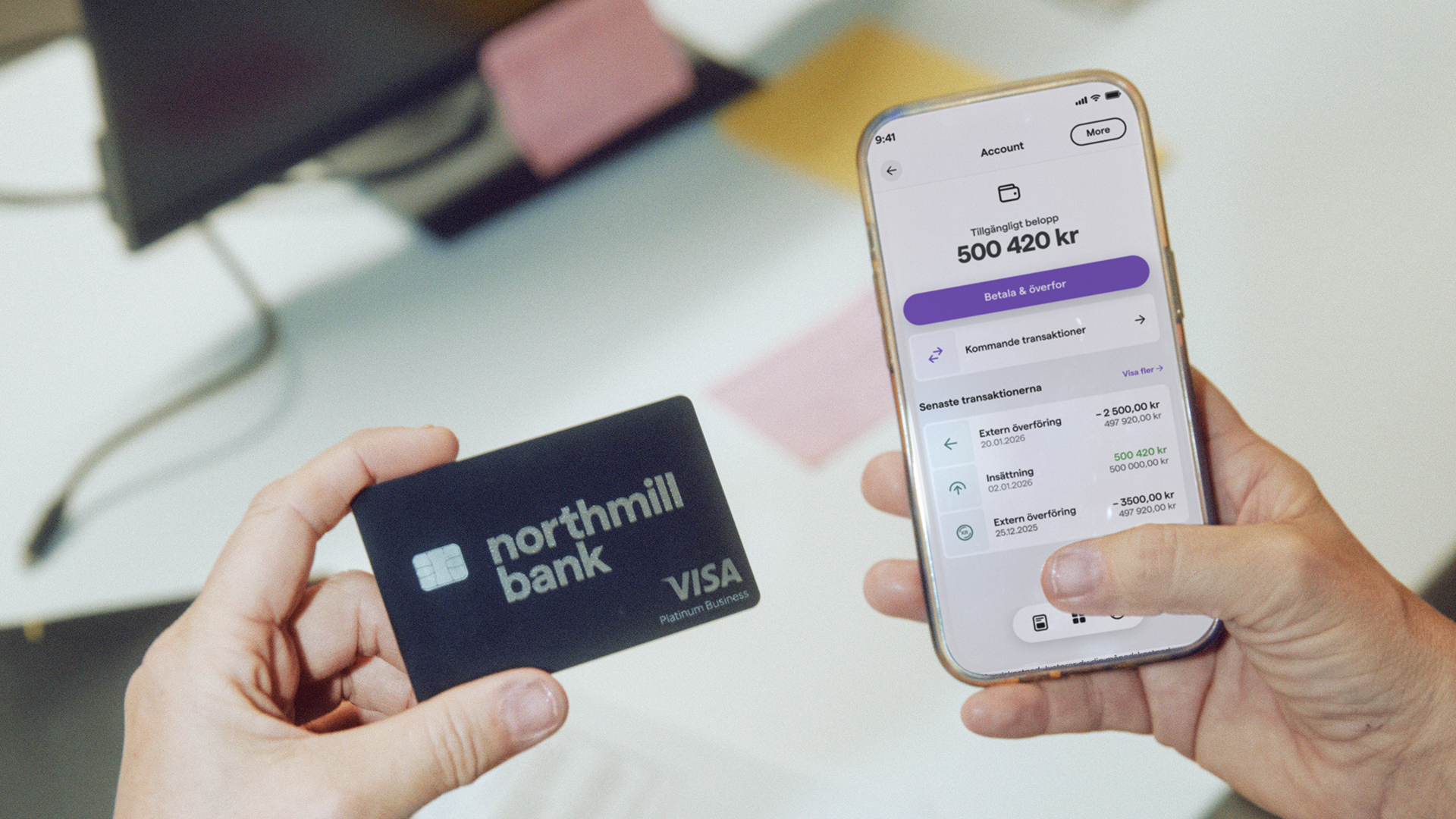

About NorthmillNorthmill is a tech-bank with the vision of improving everyone’s financial life. Founded in Stockholm, Sweden in 2006, Northmill develops customer-centric and accessible products that help everyone save money and time. Northmill has 200 000 customers and 145 employees, with over 50 percent working with IT, in three countries. Northmill Bank AB acts under the supervision of Finansinspektionen, the Swedish Financial Supervisory Authority and is subject to the Banking and Financing Business Act (2004:297).