Northmill Group AB (publ), Interim Report Q1 2025

Strong transaction growth and reduced credit losses generate sharp profit increase

Stockholm, 20 May 2025. Northmill Group AB (publ) reported a strong start to 2025 with quarterly earnings before tax up 95% year-over-year, driven by an accelerated increase in transaction-based revenues, portfolio growth and significantly reduced credit losses. The company’s transaction income increased 19% YoY, significantly outpacing lending income growth (7%), as the loan portfolio grew by 13%.

Julie Chatterjee, CEO of Northmill Group, commented: “We established our roadmap with a clear sense of ambition and purpose in 2024. This quarter clearly shows that our initiatives are delivering results. We will continue to accelerate our growth and broaden our product range throughout 2025.”

Transaction-led growth propels operating income

“Half of our quarterly profit improvement stems directly from reduced credit losses, reflecting enhanced credit management, complemented by substantial transaction growth. This highlights the increased emphasis on our high-value revenue model,” said Emil Folkesson, CFO, Northmill Group.

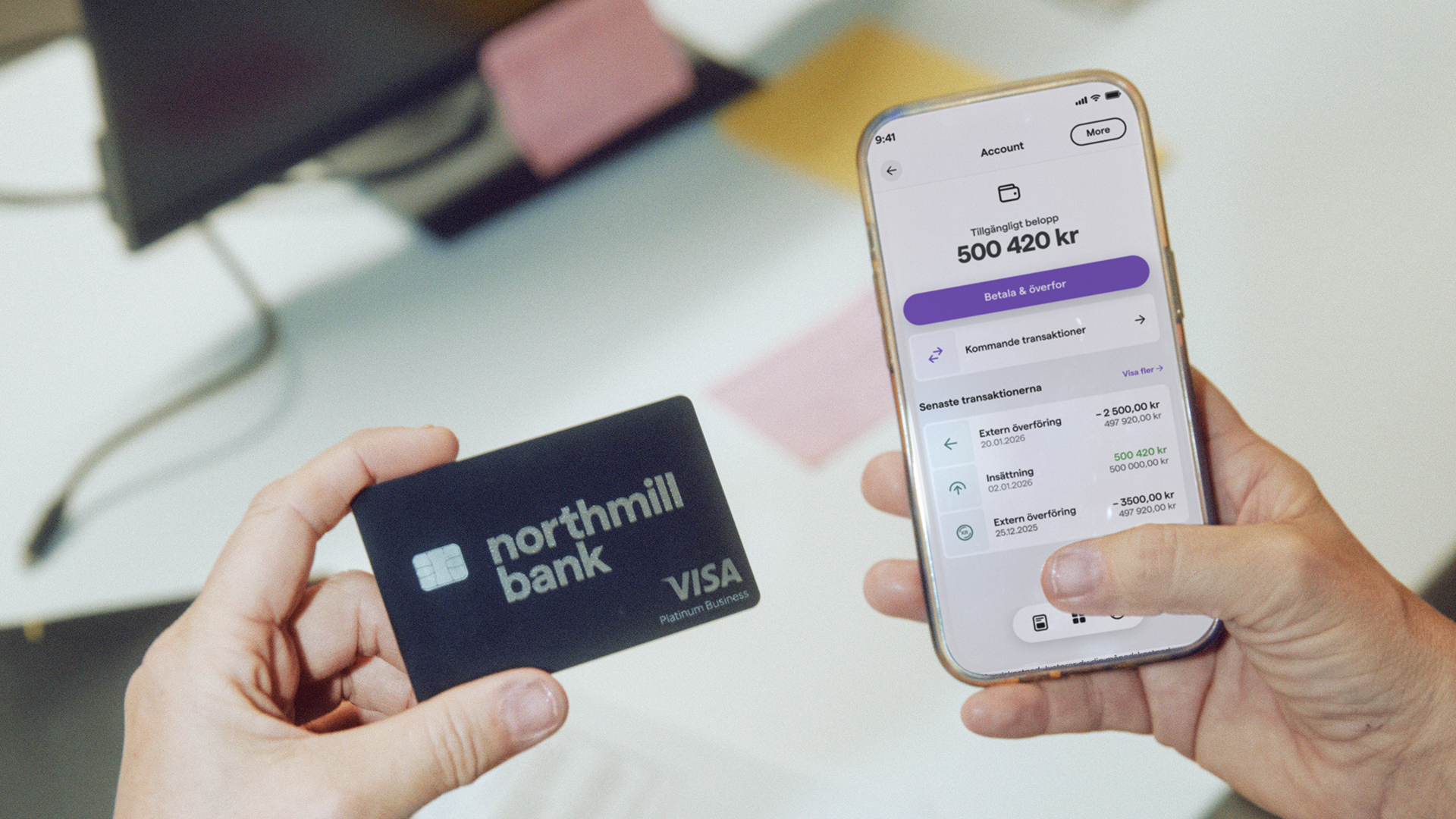

Operating income increased by 13%, which is in line with historical trends. Notably, the composition of this growth stands out: transaction income, accounting for 11% of total operating income, grew by 19%, outpacing portfolio income growth by 12 percentage points. This momentum is evident across both Northmill’s B2C and B2B segments.

The fully licenced challenger bank takes on Nordic incumbents

Northmill, which holds a full Swedish banking licence, positions itself distinctly from traditional banks. The company is continuously expanding to become a full-service alternative to Nordic incumbents for both consumers and businesses, and demonstrates strong momentum.

The Stockholm-based challenger bank has twice been ranked among Europe’s fastest-growing companies by the Financial Times. In Q4 2024, it became the first Swedish bank to complete a payment through the Swedish Riksbank’s new infrastructure for real-time account to account payments, RIX-INST. In the same quarter, Julie Chatterjee was the only CEO from a Swedish bank invited to speak at the FT's annual Global Banking Summit.