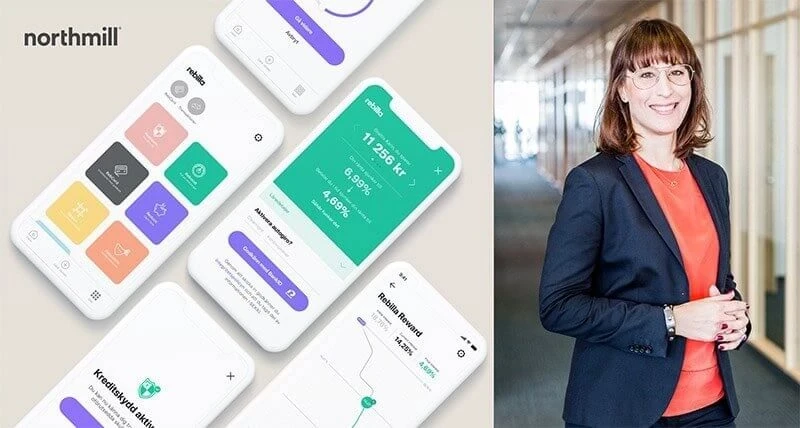

Northmill invests in customer experience

- A vital step to meet all customers on their terms

The Swedish tech bank Northmill has invested in a new cloud-based platform from leading CRM company Zendesk, Inc. That today is being used by companies such as Airbnb and Uber. The purpose of the investment is to give the employees the best possible tools to meet all the customers on their terms. At the same time, the tech bank aims to strengthen the connection between the customers’ feedback and what type of products and features are being developed.

Simon Nilsson, Chief Customer Officer at Northmill commented:

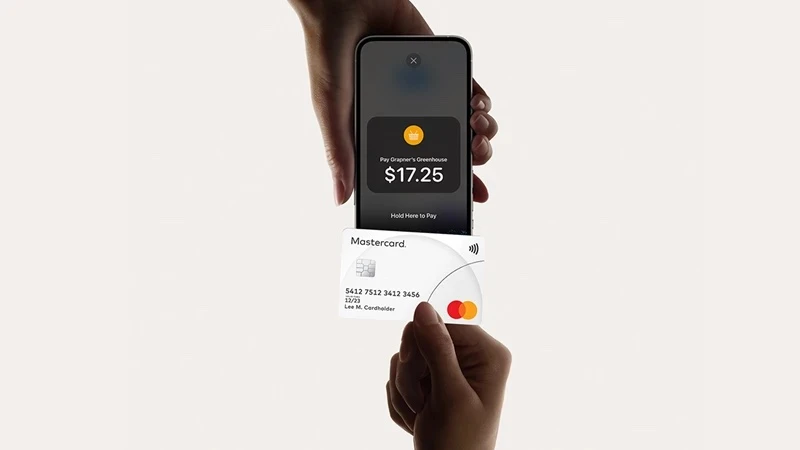

“We are building a bank for everyone and this is an investment in our employees and the customer experience, two things that are tightly intertwined. We can see a growing trend with many companies taking the path of solely investing in self-service solutions, but we know that many people still ask for the opportunity to connect via for example phone. Now we are creating a hybrid where we will have a very competitive self-service offer, but we will also be available in the way the customers prefer - including chat, phone, mail, Facebook or WhatsApp. In addition, we will continue to strengthen our existing customer service team across all markets to handle the growing demand.”

Today, Northmill has a queuing time over the phone at an average of 30 seconds and the customer satisfaction percentage is very high. Ninety percent of the customers who choose to leave a rating via the chat is positive. But the tech bank is not yet satisfied and well aware that it takes ongoing investments to stay relevant towards the ever-changing needs of customers.

Simon Nilsson continued:

“We are now able to gear up our efficiency, be proactive and take full-scale data-driven decisions. We are also able to gather all the insights in a single platform. It creates a very streamlined process for our employees and enables us to strengthen the connection between the feedback we receive from customers, and how we develop our products. The new platform takes it a step further than traditional omni-solutions and provides us with the opportunity to develop and deploy our own apps in the interface and achieve a tailored 360-view of the customers’ needs.”

Northmill needed a scalable and sustainable solution that responds to the rapidly growing product portfolio, which among other things holds and , the strong requirements on security and transparency as well as a solution that manages the bank's upcoming European expansion.