Northmill expands to Norway

Northmill Bank launched Reduce in Norway to help customers lower interest rates on existing loans.

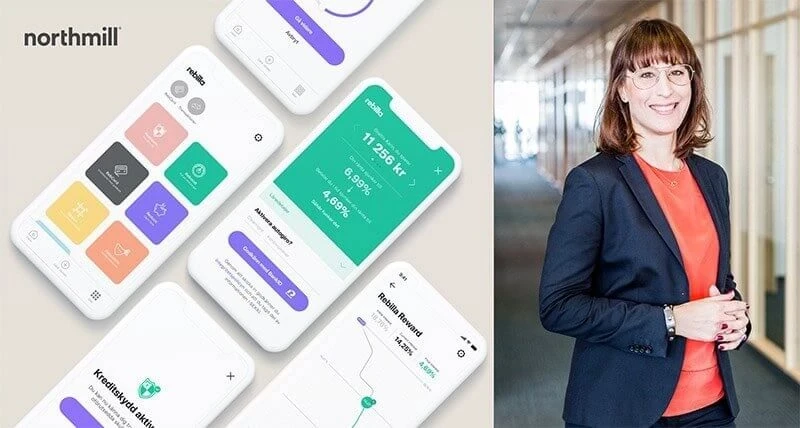

The neobank Northmill, which has the vision of improving people's financial life, is entering the Norwegian market. The first step is an entry into the refinancing market with Reduce, which has already helped thousands of Swedes lower their interest rates on existing loans, installments and private loans. The refinancing market in Norway is estimated to be worth NOK 153 billion. With a tailor-made and proven service, the neobank aims to compete with the established players.

Hikmet Ego, CEO and co-founder of Northmill Bank, comments:“We have listened to the feedback that the Reduce-users in Sweden have given us and continuously developed the service, because there is really a positive force in including customers in the product development. We are now ready to take Reduce outside of Sweden, and we feel confident that we have a very competitive product that will help many people reduce their interest costs. The goal is to be able to offer more products and services in the future that help people improve their personal finances in the Norwegian market.”

The total number of unsecured loans in Norway amounts to 7.7 million with a total volume of NOK 153 billion. The demand among consumers for services that help them reduce their interest costs is high, and Northmill, which is a completely cloud-based and digital bank, sees its proven services having a given place in the market.

Jamal Hussain, Country Manager of Northmill Norway, comments:“We always strive to be as relevant as possible and offer banking services that we know people want and will benefit from. Today, many people pay a too high interest rate and today's customers do not have the same loyalty to their bank as before. As a customer, you are active and choose to move over certain services if more tailor-made solutions are offered, and not least, if you find better prices elsewhere. This is where Reduce comes in. Reduce has succeeded in helping people lower their interest costs at all levels in Sweden. We attract customers from both major banks and from buy-now-pay-later (BNPL) companies and credit companies.”

Northmill is the highest ranked company within the banking category on Trustpilot in Sweden, and the personal contact and the opportunity to talk to a person is an important explanation for the high customer satisfaction.

“We are obsessed with the customer experience and while being very technology-driven, we still think that you should be able to call us to get help and answers to your questions. There does not have to be a contradiction between being state-of-the-art, having the latest technology, and providing personal service. On the contrary, that is how you remain relevant”, says Jamal Hussain.

Northmill was granted a Swedish banking license at the end of 2019 and has twice been named one of the fastest growing companies in Europe. Today, the neobank has an offer that extends over payments, savings, credits, refinancing and insurance.