Northmill Bank broadens its savings offering

Northmill Bank broadens its savings offering with a new fixed-rate account, backed by state-provided deposit insurance

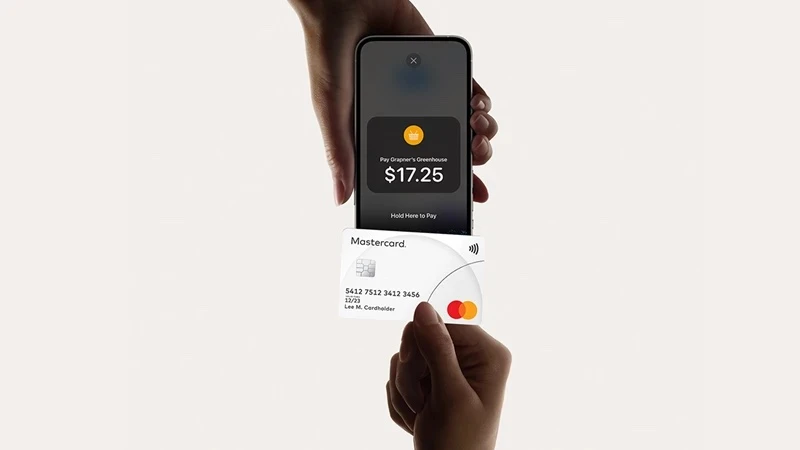

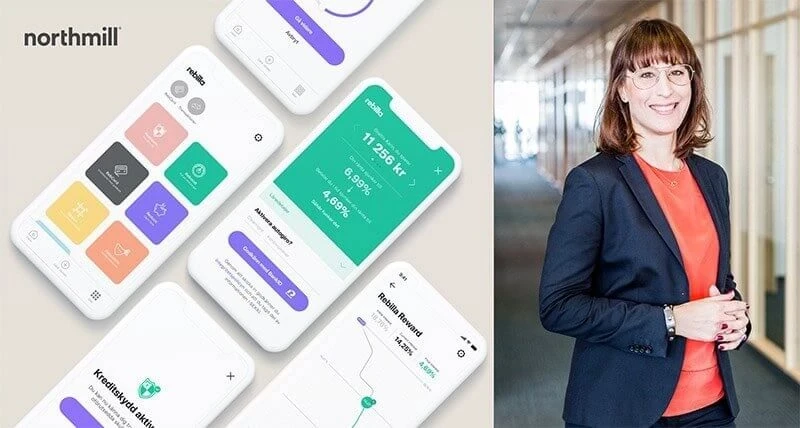

Stockholm 7 July 2020: The Swedish tech bank Northmill that helps people to improve their financial lives, strengthens its offering within savings by introducing its first fixed-rate savings account. The account has a 1.15 percent annual interest rate with a fixed period of twelve months. Earlier this year, Northmill launched a savings account with a variable interest rate of, at date, 0.95 percent, free withdrawals and state-provided deposit insurance.

Hikmet Ego, CEO at Northmill Bank commented:

“We have seen an increased demand for different types of savings accounts, especially with the current uncertainty in the markets. Now we provide a safe and secure way for people to get predictability and grow their money. We also see that many customers seek a complement to their traditional banks’ offerings which we provide with our digital and mobile-friendly alternative that in addition offers competitive interest rates.”

The launch of the fixed-rate savings account exemplifies the tech bank's continued focus on growing its savings-offering and adding new products and features to help people improve their financial lives.

Jacob Thordson, Product Owner Accounts at Northmill Bank commented:

“We have a customer satisfaction rate of over 90 percent and a scalable technical infrastructure. It provides us with very good prerequisites to grow our bank offering and to continuously add products and features that help people in their everyday lives. We constantly update our products based on the feedback we receive from our customers, and we have several exciting product launches planned in the near future.”